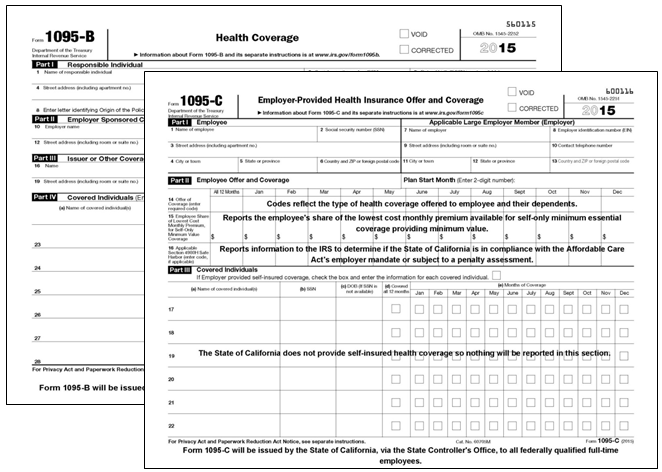

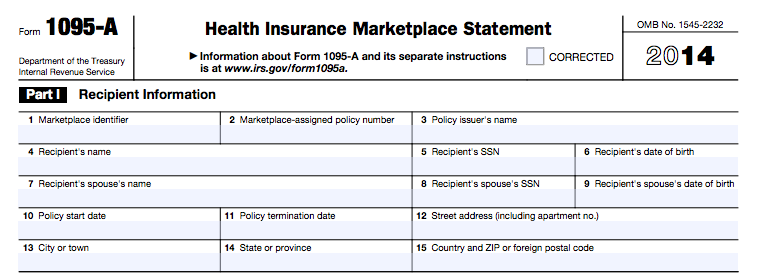

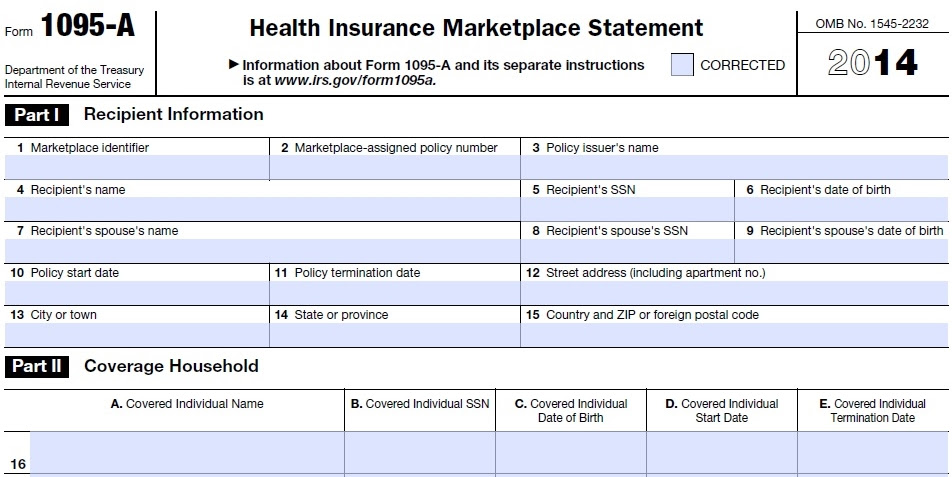

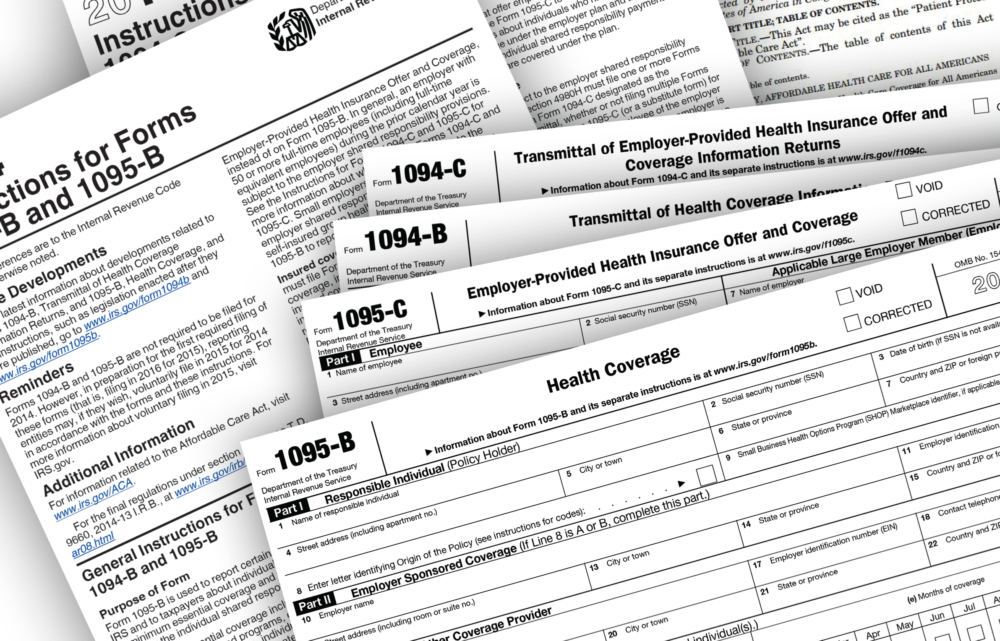

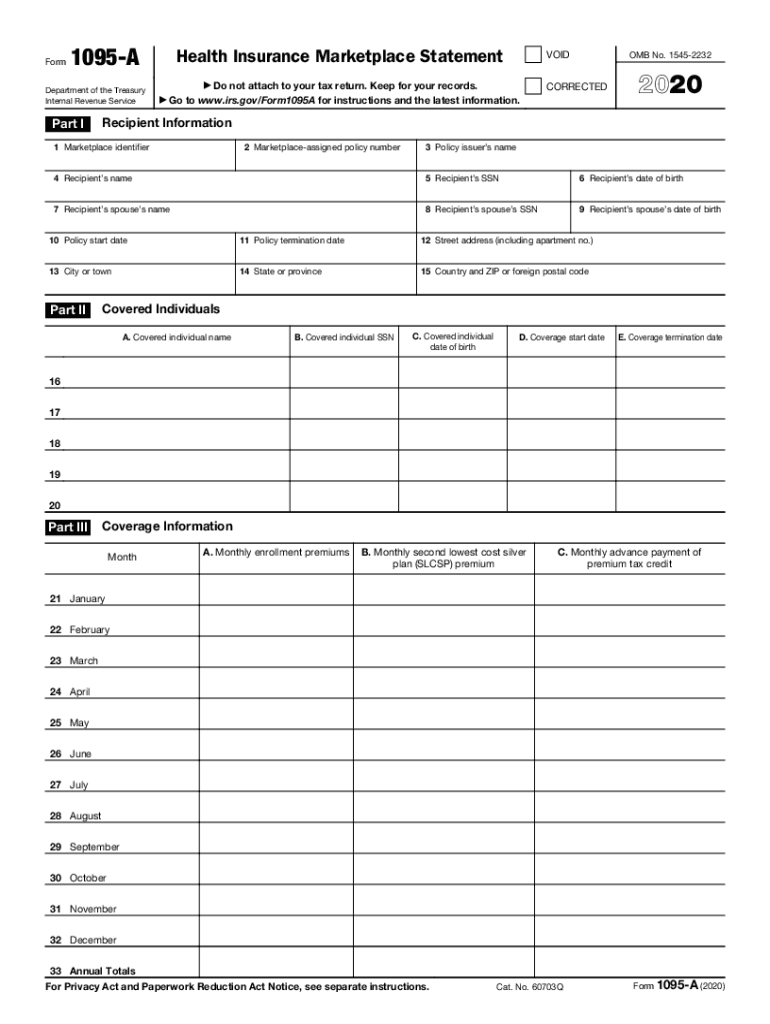

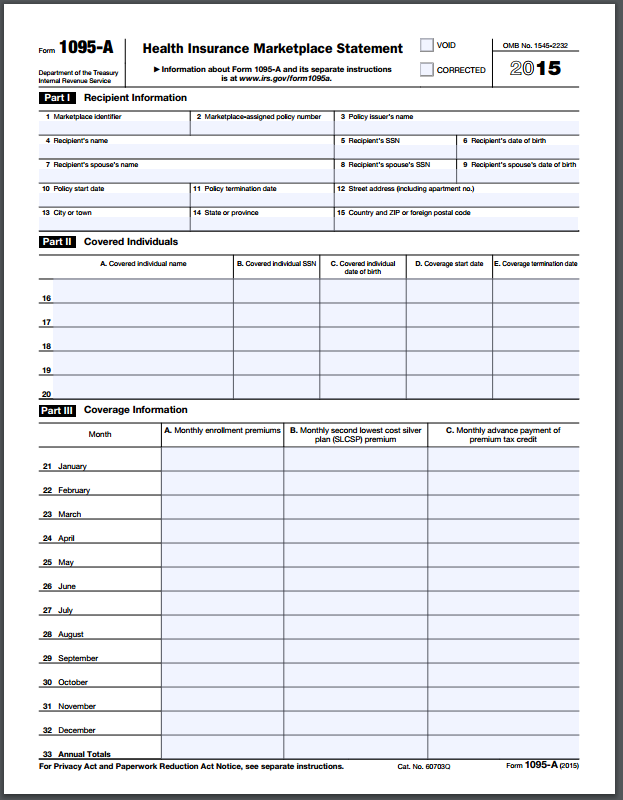

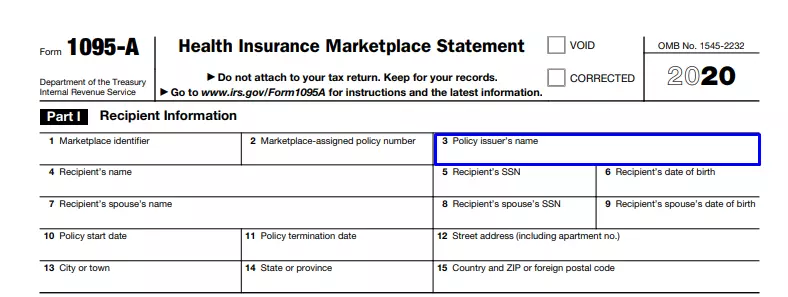

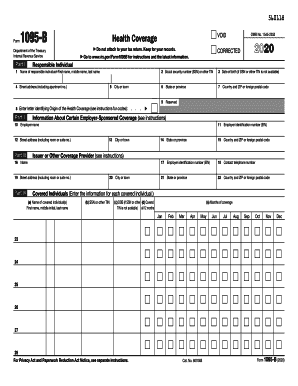

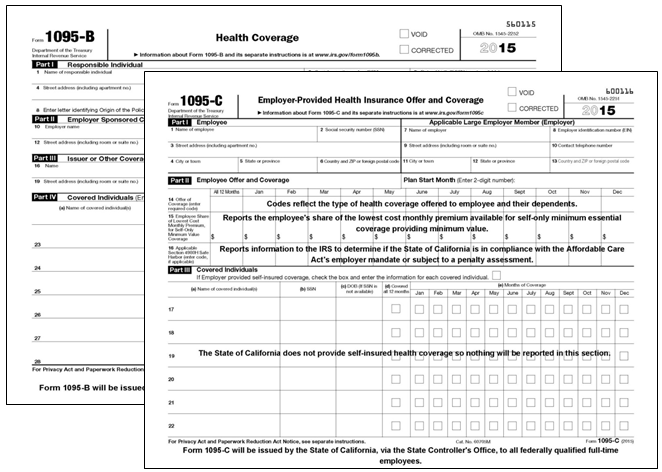

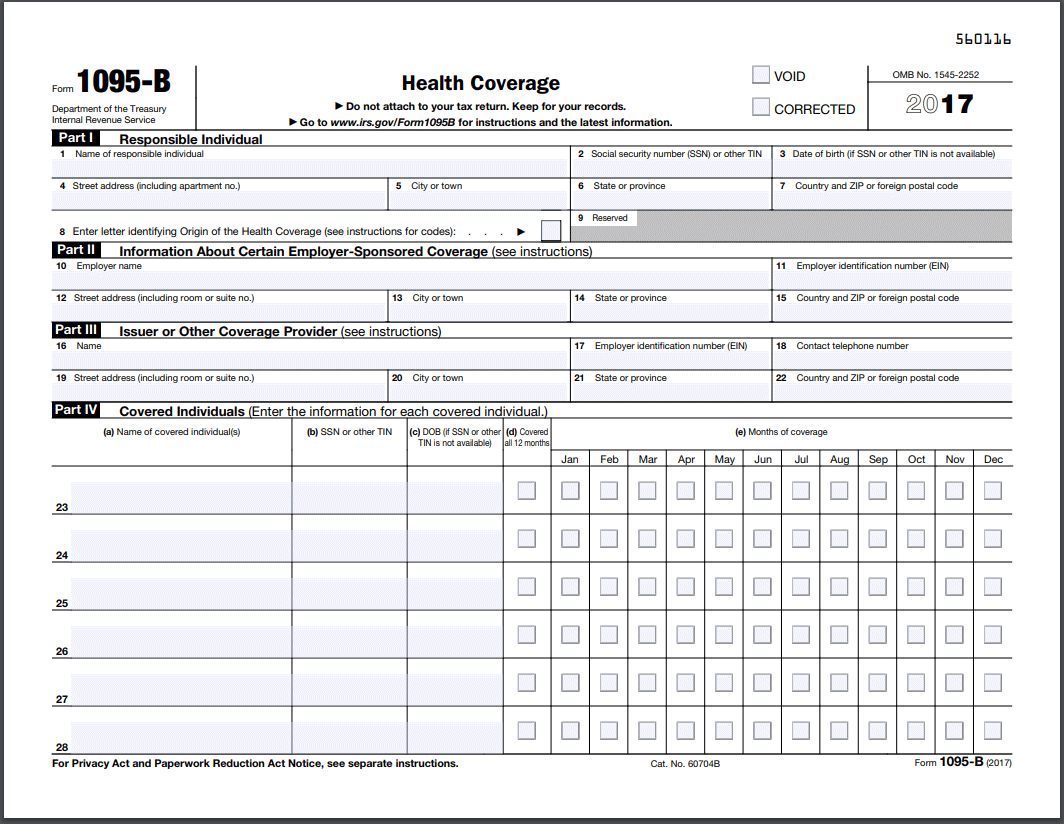

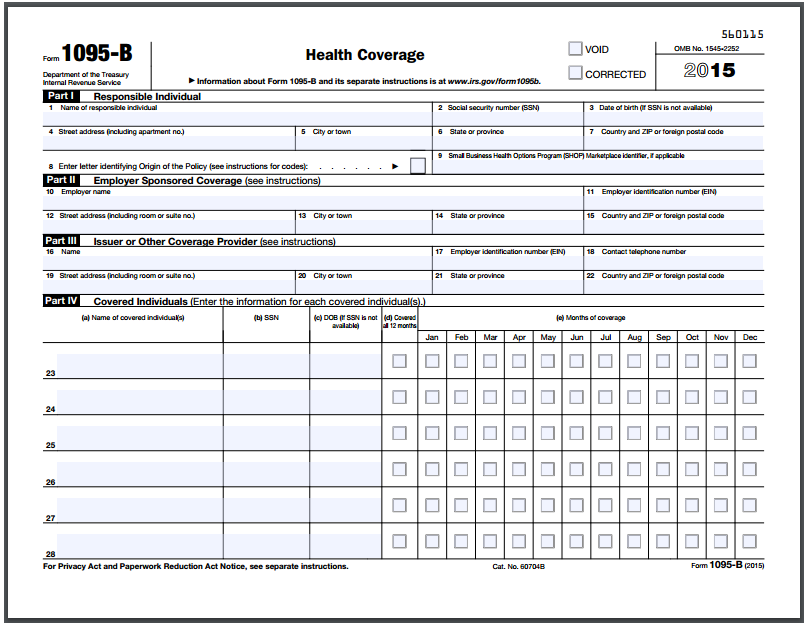

IRS Form 1095A, Health Insurance Marketplace Statement, also known as the healthcare marketplace tax form, is a document used to report information to the Internal Revenue Service (IRS) about the individuals enrolled in a qualified health plan via the Health Insurance Marketplace The Health Insurance Marketplace is a platform where people without health care insurance canThe 1095 is a tax form that shows the health care coverage you had in the previous year Due to recent tax law changes 1, if you bought your health plan directly from Blue Cross and Blue Shield of Texas (BCBSTX) 2 or got your BCBSTX health plan through your job 3, the IRS says you no longer need Form 1095B to file your federal income taxesThis change is as of January 21IRS Form 1095B, Health Coverage, is a document used to submit certain information to the Internal Revenue Service (IRS) and to taxpayers about individuals who have minimum essential coverage and are not liable for the individual shared responsibility paymentMinimum essential coverage means individual market plans, plans sponsored by eligible employers, and programs sponsored

Annual Health Care Coverage Statements

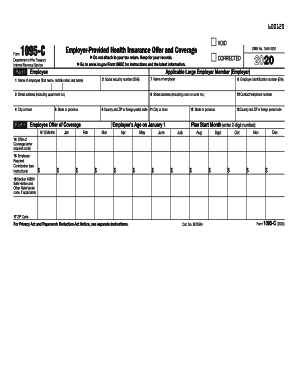

Marketplace identifier 1095-c 2020

Marketplace identifier 1095-c 2020-If anyone in your household had a Marketplace plan in , you should get Form 1095A, Health Insurance Marketplace® Statement, by mail no later than midFebruary It may be available in your HealthCaregov account as soon as midJanuary IMPORTANT You must have your 1095A before you file Don't file your taxes until you have an accurate 1095A10/29/ · ACA Form 1095C Filing Instructions An Overview Updated October 29, 800 AM by Admin, ACAwise When the Affordable Care Act was passed, the IRS designed Section 6056 of the Internal Revenue Code as a way to gather information on the health insurance coverage that ALEs offered to their employees

1095 A Tax Credits Subsidies For Form 62 Attaches To 1040 Covered Ca

· December 11, 19 The IRS has announced a welcome extension of the due date for certain entities to provide 19 health coverage information Forms 1095B or 1095C to employees and individuals Limited penalty relief is also extended to the 19 Forms Visit this IRS webpage for information on the health coverage forms requirement Due Date Extended to IssueThe health connector has no information related to our enrollments, and mass health tells me they do not send out a 1095A So how do I get my 1095A to file my taxes?This determination will apply for the tax year;

I'm covered through my employer You should receive Form 1095B or 1095C, depending upon the size of your employer You should have received it either in the mail in January from Premera, or from your employer1/5/ · Important information Kaiser Permanente is scheduled to start mailing Form 1095B to primary account owners (also known as subscribers) on January 5, These forms will be sent out through the rest of the month, to subscribers in all regions, until we've finishedPlease allow some time for them to arrive CA Individual Mandate California Senate Bill 78 was signed by2/24/18 · Marketplace US (ATVPDKIKX0DER) of course and SellerId 6AXV How about that I didn't think of looking so closely at the data in the url Very cool, thanks AMAZIN_BARGAINS UTC #9 What are the answers to these questions Merchant ID Marketplace

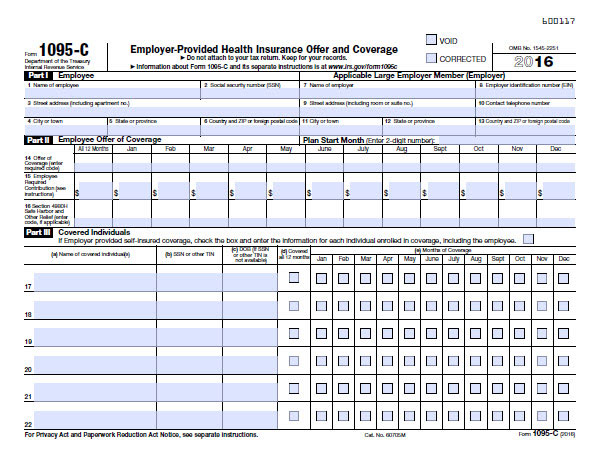

6/8/19 · Edited If you have a 1095C, a form titled EmployerProvided Health Insurance Offer and Coverage the IRS does NOT need any details from this form You can keep any 1095C forms you get from your employer for your records When you come to the question "Did you have health insurance coverage in 15", simply select "Yes"3/17/16 · 1095C Forms According to Forbes, the forms 1095A and 1095B are new for the 15 tax season These two forms come from employers;If you do wish to claim the premium tax credit you, will need Part II of Form 1095C this only applies if you purchased additional healthcare through the marketplace and received a 1095A If you received health insurance through the Health Insurance Marketplace (also known as an Exchange), your coverage will be reported on a 1095A and you will need to provide Form 1095A information with your

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

4 New Hardship Exemptions Let Consumers Avoid Aca Penalty For Not Having Health Insurancekaiser Health News

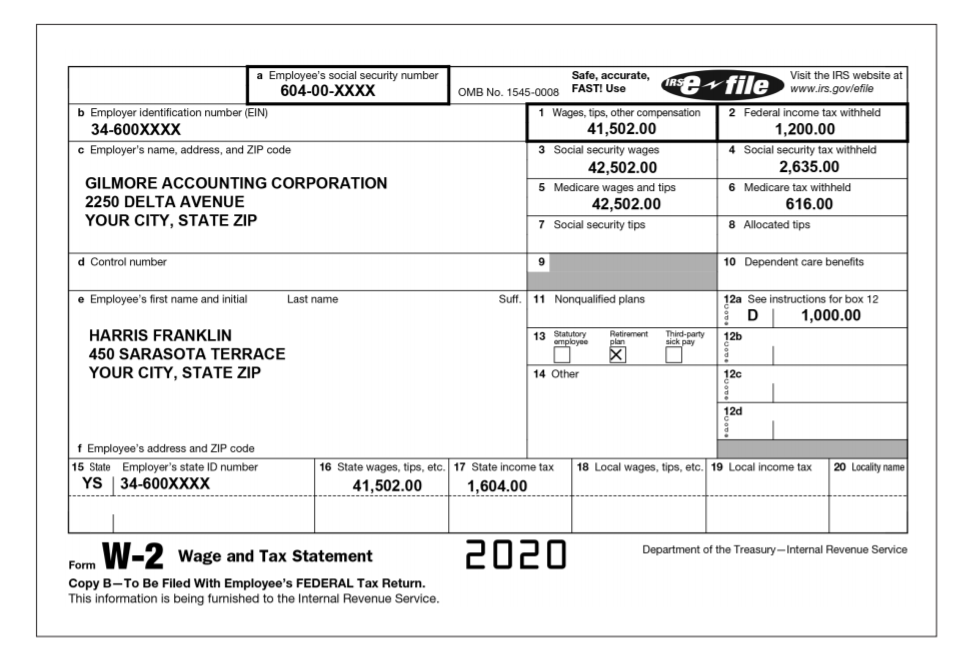

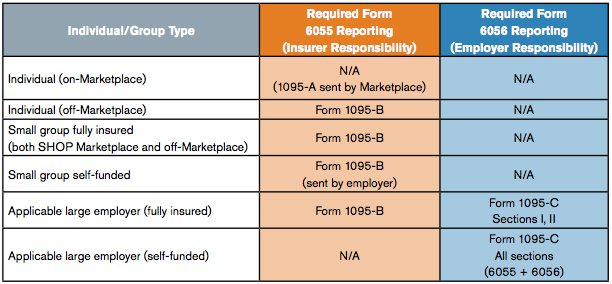

*Updated for tax year 16 In January, aside from receiving your usual Form W2 from your employer, you may receive Form 1095C related to the Affordable Care Act (ACA) If you received health insurance outside of the marketplace exchanges in 16, and worked for a large employer, look for Form 1095C, EmployerProvided Health Insurance Offer and Coverage, to arrive in yourForms 1095B and 1095C are not required with your Tax Return You are no longer required to report your health insurance on your return UNLESS you or a family member were enrolled in health insurance through the Marketplace and advance payments of the Premium Tax Credit were made to your insurance company to reduce your monthly premium payment When you prepare your tax return on eFilecom, you can easily report and efile9/3/ · These employers file Form 1095C because they select and purchase health plans on behalf of their employees and must meet minimum essential requirements to offer those plans NOTE Selfinsured companies with 50 or more fulltime employees are required to combine 1095B and 1095C information into a single 1095C form

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

The Abcs Of Forms 1095 A 1095 B 1095 C American Exchange

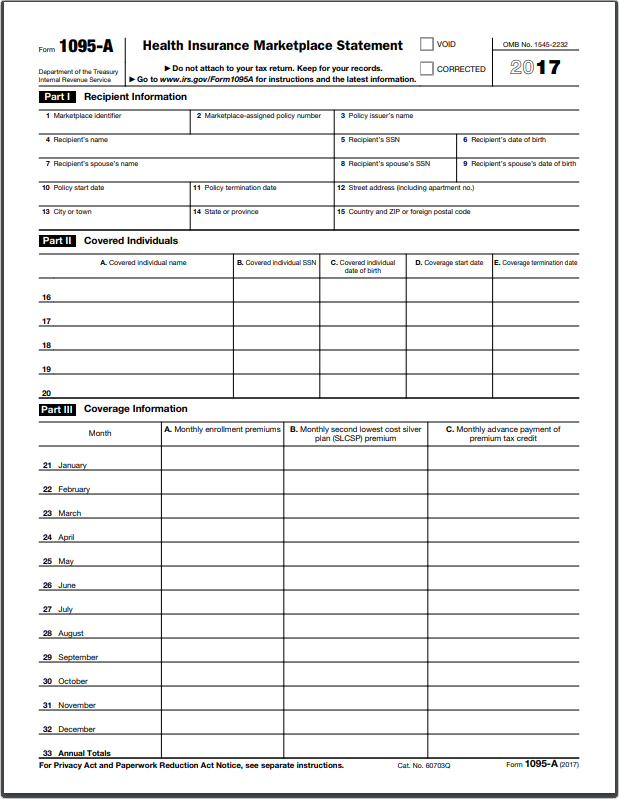

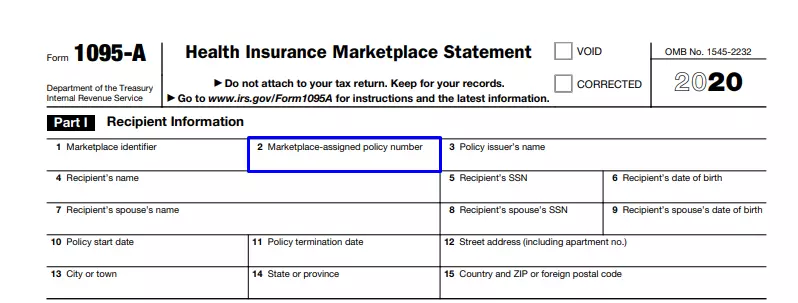

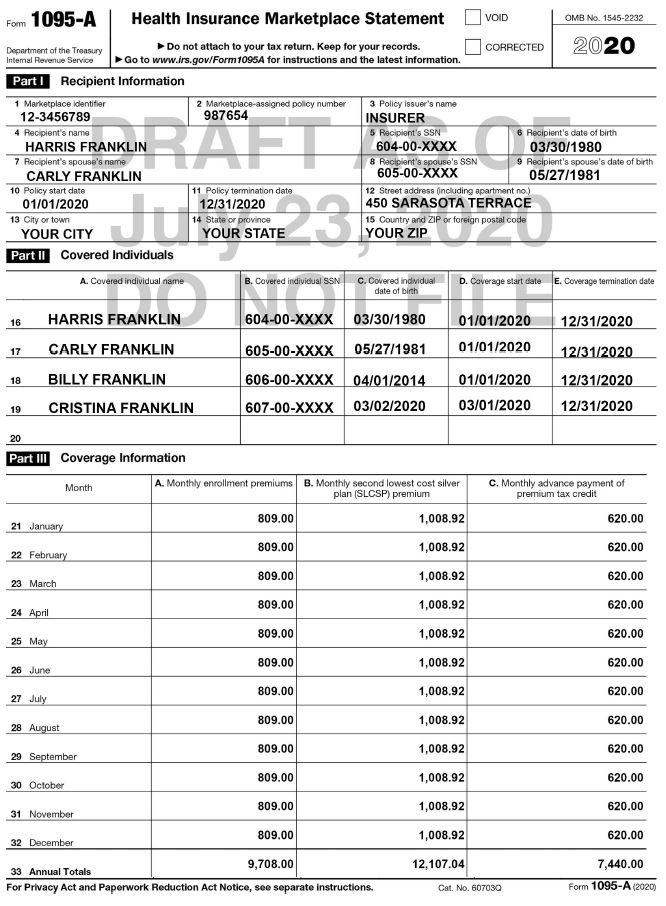

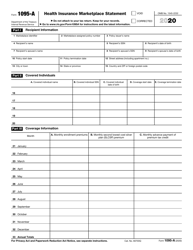

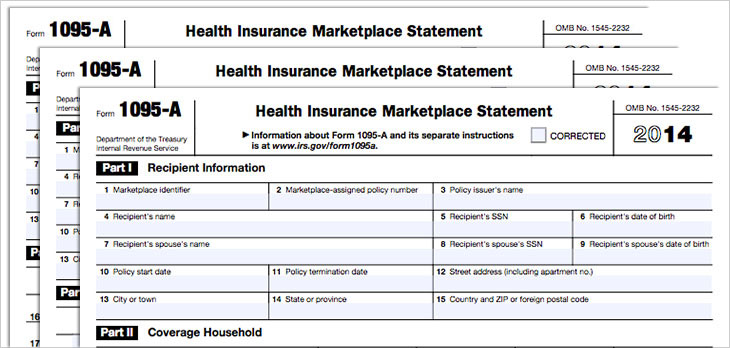

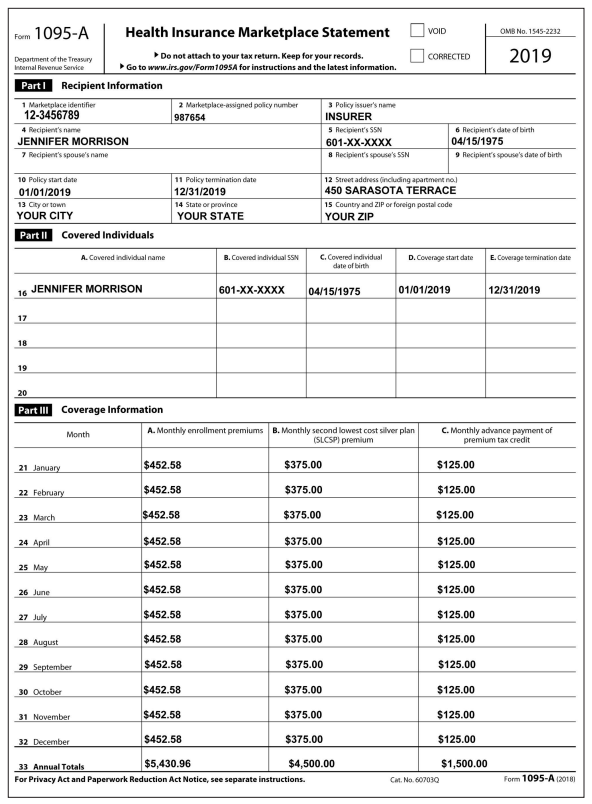

1/18/15 · Line 1 Marketplace identifier The abbreviation of the Federal or State Marketplace from which you got your coverage Line 2 Marketplaceassigned policy number Your policy number as assigned by the Marketplace If it's greater than 15 characters, only the last 15 characters show Line 3 Policy issuer's nameIn Part II of Form 1095C, for , the employer is required to input the age of the employee as of January 1st for any employee offered an ICHRA Further, on Line 14, Codes 1L through 1S have been introduced to capture offers of coverage for ICHRAs The addition of these codes induces changes to Part II, Line 15 of the Form 1095C in some cases2/8/15 · If you don't have your 1095A form you can view it online You can also contact the Marketplace Call Center if you find any errors on your 1095A NOTE This page was compiled over the years in a response to people's questions with 1095A forms The information below remains important However, we suggest anyone dealing with 1095A issues see the latest update from

Covered California Income Limits Explained

1095 A Tax Credits Subsidies For Form 62 Attaches To 1040 Covered Ca

OFFICE OF LABOR RELATIONS 22 Cortlandt St 14th Floor, New York, NY nycgov/olr January 21 TO ALL CITY, CUNY COMMUNITY COLLEGES, WATER AUTHORITY, AND HOUSING AUTHORITY EMPLOYEES FROM THE NEW YORK CITY OFFICE OF LABOR RELATIONS (OLR) EMPLOYEE BENEFITS PROGRAM SUBJECT FORM 1095C INFORMATION The following1/5/ · Important information Kaiser Permanente is scheduled to start mailing Form 1095B to primary account owners (also known as subscribers) on January 5, These forms will be sent out through the rest of the month, to subscribers in all regions, until we've finished Please allow some time for them to arrive CA Individual MandateThe Marketplace helps you and your family enroll in health insurance coverage You may also receive financial assistance to help pay for it Small Business Owners NY State of Health provides affordable health insurance to your employees and their families You may also receive tax credits when you use the Marketplace

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them

How To Get Form 1095 A Health Insurance Marketplace Statement Picshealth

A If you enrolled in a Qualified Health Plan (like Ambetter) through the Washington Healthplanfinder, you will receive an important tax return documented called the 1095A Health Insurance Marketplace Statement in the mail You will need to use information on this form to complete the IRS Form 62 Premium Tax CreditForm 1095A comes from the Marketplace Individuals will receive Form 1095C if they work for aI've been pushed back and forth with health connector and mass health for

Harris And Carly Franklin Are Married And Choose T Chegg Com

New 1095 C Codes Will Apply To The Tax Year Aca The New 1095 C Codes For Explained

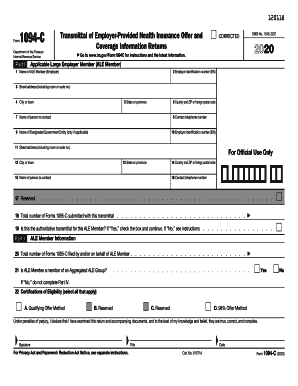

1095C Reports information on health coverage offered and information on employees and dependents enrollment in that coverage Employer for selffunded plans IRS Individual Learn more about form 1095C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns 1094C11/7/ · Form 1095C is sent out to those who enrolled in a health plan through the Health Insurance Marketplace In 21, you will be furnished with a Form 1095C reporting the information you need to know about the plan you enrolled in The purpose of Form 1095C is to provide you the information you need to know about claiming the premium tax credit,People who purchase insurance through the Marketplace may be able to lower the costs of health insurance coverage by paying lower monthly premiums The 21 Health Insurance Marketplace open enrollment period was November 1, through December 15, For more information, visit https//wwwhealthcaregov/getcoverage/

2 3 86 Command Code Irpol Internal Revenue Service

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

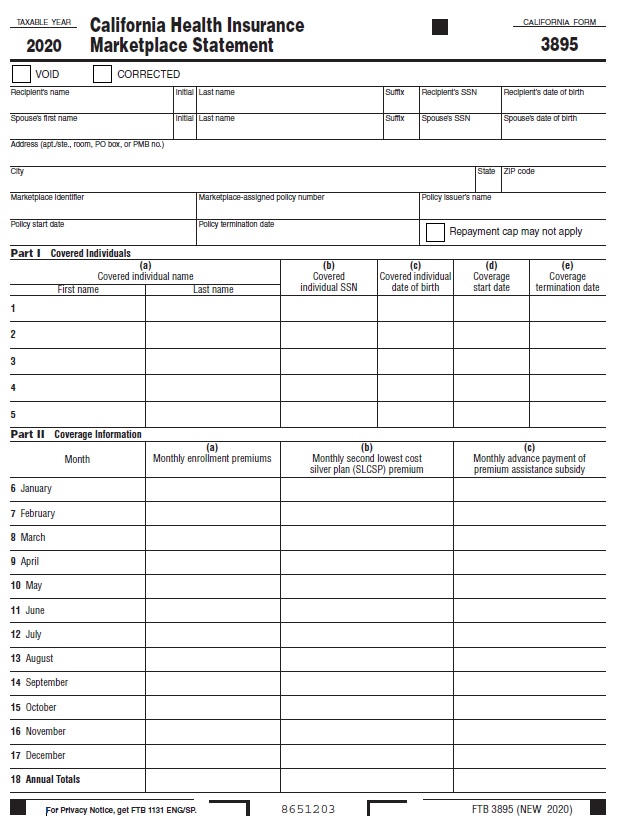

Marketplace As the form is to be completed by the Marketplaces, individuals cannot complete and use Form 1095A available on IRSgov Individuals receiving a completed Form 1095A from the Health Insurance Marketplace will use the information received on the form and the guidance in the instructions to assist them in filing an accurate tax returnAnd 1095C General Information Purpose Form FTB 35, California Health Insurance Marketplace Statement, is used to report certain information to the Franchise Tax Board (FTB) about individuals who enroll in a qualified health plan through the California Health Insurance Marketplace (Marketplace) The term "Marketplace" refers to6/5/19 · See this TurboTax support FAQ for a Form 1095C https//ttlcintuitcom/questions/doineedtoentermy1095c Start the Health Insurance section over If you had coverage for the whole year indicate that Where asked if you had one of the less common plans shown, click on NO, since you have a Form 1095C Click

The Abc S Of Forms 1095a 1095b And 1095c Aca Gps

Form 1095 A 1095 B 1095 C And Instructions

Audit Support Guarantee If you received an audit letter based on your TurboTax return, we will provide oneonone support with a tax professional as requested through our Audit Support Center for returns filed with TurboTax for the current tax year () and the past two tax years (19, 18) If we are not able to connect you to one of our tax professionals, we will refund theForm 1095C For those whose employer provides coverage and has 50 or more fulltime employees Which 1095 will I receive?2/24/ · Every year Applicable Large Employers ("ALEs") must file Forms 1094C and 1095C with the IRS and furnish Forms 1095C to employees considered fulltime under the Affordable Care Act ("ACA") Forms 1094C and 1095C are used in combination with the IRS automated Affordable Care Act Compliance Validation (ACV) System to determine whether an ALE owes

The Abcs Of Forms 1095 A 1095 B 1095 C American Exchange

Form Irs 1094 B Fill Online Printable Fillable Blank Pdffiller

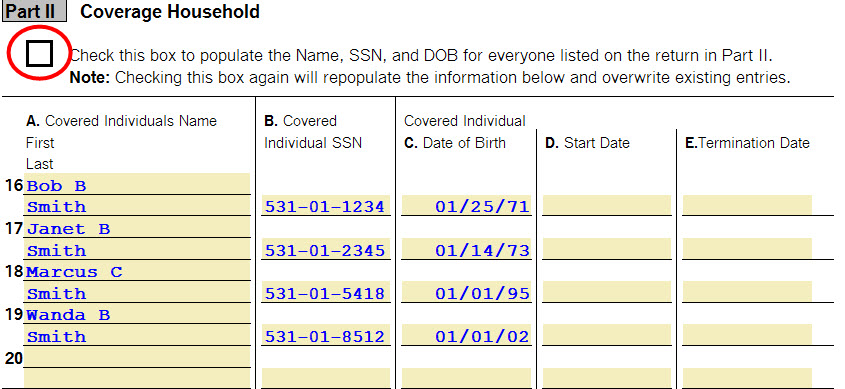

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How works Test new features Press Copyright Contact us Creators3/23/21 · Form 1095C –Individuals who enroll in health insurance through their employers will receive this form If you got any of the forms identified above, do not throw them away The 1095 Forms serve as proof of qualifying health coverage during the tax year reported Who Gets a Form 1095B Who will get his or her own Form 1095B?Your 1095A includes information about Marketplace plans anyone in your household had in 19, so you may receive multiple 1095A forms if family members enrolled in different plans You must have your 1095A before you file, so don't file your taxes until you have an accurate 1095A

Tax Credits Solid Health Insurance

15 Form Irs 1095 A Fill Online Printable Fillable Blank Pdffiller

Form 1095C contains information about the health coverage offered by your employer in This may include information about whether you enrolled in coverage Use the information contained in the 1095C to assist you in determining in you are eligible for the premium tax credit3/12/21 · If you or anyone in your household enrolled in a health plan through the Health Insurance Marketplace, you'll get Form 1095A, Health Insurance Marketplace Statement You will get this form from the Marketplace, not the IRS You will use the information from the Form 1095A to calculate the amount of your premium tax creditWhen to file You must file your information returns and recipient copies by specified due dates The tables below provide the due dates for filing information returns to us and to the recipient If any date shown falls on a weekend or holiday, the due date is the next business day

Form Irs 1095 A Fill Online Printable Fillable Blank Pdffiller

Form 1095 A 1095 B 1095 C And Instructions

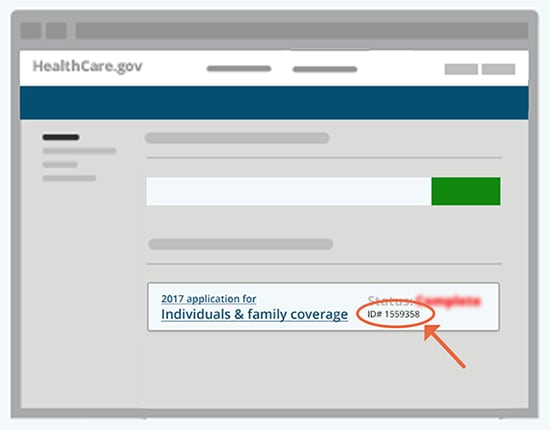

3/2/21 · On Oct 2, , the IRS announced it would extend the deadline for employers to provide employees with a copy of their 1095C or 1095B reporting form, as required by the ACA, from Jan 31, 21The federal IRS Form 1095A Health Insurance Marketplace Statement The California Form FTB 35 California Health Insurance Marketplace Statement Use the California Franchise Tax Board forms finder to view this form These forms are used when you file your federal and state tax returns to Calculate your tax refund or credit or the tax amountLog into your Marketplace account STEP 2 Under Your Existing Applications, select your application — not your 21 application STEP 3 Select Tax Forms from the menu on the left How to find your Form 1095A online 2

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Irs Form 1095 A Download Printable Pdf Or Fill Online Health Insurance Marketplace Statement Templateroller

1095C — Issued by employers to subscribers of fullyinsured midlarge sized (51) group health plans, as well as those subscribers enrolled in a selffunded group health plan administered by AmeriHealth New Jersey What to do if you received a 1095B with a missing SSN2/16/21 · For Tax Year Even though IRS Form 1095B isn't required to file taxes, you may still request an IRS Form 1095B listing the coverage you had during from your pay center Visit the Defense Finance and Accounting Service (DFAS) to request an IRS Form 1095B You can also visit the Internal Revenue Service for more informationCat No M Form 1095C () Form 1095C () Instructions for Recipient You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act

Irs Form 1095 A Fill Out Printable Pdf Forms Online

Aca Reporting Irs Drafts Changes For 16 Forms And Instructions Aca Track

1095 a A taxesThe resources on this page provide information about your Form 1095A from NY State of Health The Form 1095A is used to reconcile Advance Premium Tax Credits (APTC) and to claim Premium Tax Credits (PTC) on your federal tax returns12/6/19 · Due to these changes form 1095B and 1095C are no longer required to be entered into the tax return and should be kept by the taxpayer for their records If your client received a form 1095A for Health Insurance Marketplace StatementThe "Marketplace" is the government's term for the online insurance markets or "exchanges" set up under the law known as Obamacare Only people who buy coverage through the Marketplace are eligible for the Premium Tax Credit If you bought your plan there, you should get a Form 1095A, also called the "Health Insurance Marketplace Statement"

Covered California Ftb 35 And 1095a Statements

919e 01 05 Internal Revenue Service Services Economics

1095 A Tax Credits Subsidies For Form 62 Attaches To 1040 Covered Ca

Application Id Healthcare Gov Glossary Healthcare Gov

2 3 86 Command Code Irpol Internal Revenue Service

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 A Tax Credits Subsidies For Form 62 Attaches To 1040 Covered Ca

Irs Updates To New Form 1094 C And 1095 C Drafts Bernieportal

How To Delete 1095 A Form

1095 A High Resolution Stock Photography And Images Alamy

The Abcs Of Forms 1095 A 1095 B 1095 C American Exchange

Can You Have Multiple Ein Numbers

Fill Free Fillable Health Insurance Marketplace Statement Form 1095 A Pdf Form

What Are 1095 Tax Forms San Diego Sharp Health News

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Irs Form 1095 Form Ftb 35 And Your Health Insurance Subsidy

Irs Form 1095 A Fill Out Printable Pdf Forms Online

Form 1095 A 1095 B 1095 C And Instructions

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Covered California Ftb 35 And 1095a Statements

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

2 3 86 Command Code Irpol Internal Revenue Service

Form 1095 C Guide For Employees Contact Us

1095 A Tax Credits Subsidies For Form 62 Attaches To 1040 Covered Ca

62 Form

The Health Insurance Marketplace

Solved 14 How Do Educator Expenses Affect Carly S Tax Re Chegg Com

Payroll Escape Technology

1095 A Tax Form H R Block

Annual Health Care Coverage Statements

Irs Form 1095 A Download Printable Pdf Or Fill Online Health Insurance Marketplace Statement Templateroller

1095 A High Resolution Stock Photography And Images Alamy

Irs Release Drafts Of Irs Forms 1094 C And 1095 C The Aca Times

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Tax Form 1095 A Frequently Asked Questions

Entering Form 1095 A 1095 B Or 1095 C Health Cove Intuit Accountants Community

919e 01 05 Internal Revenue Service Services Economics

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

Publication 974 Premium Tax Credit Ptc Internal Revenue Service

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Irs Form 1095 A Download Printable Pdf Or Fill Online Health Insurance Marketplace Statement Templateroller

What Is Form 1095 C And Do You Need It To File Your Taxes

Form1095a 19 5 Pages 1 8 Flip Pdf Download Fliphtml5

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

How To Get Form 1095 A Health Insurance Marketplace Statement Picshealth

What Is Form 1095 C And Do You Need It To File Your Taxes

Guide To Form 1095 H R Block

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

The New 1095 C Codes For Explained

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

The Abcs Of Forms 1095 A 1095 B 1095 C American Exchange

What Is Form 1095 C And Do You Need It To File Your Taxes

Irs Form 1095 A Download Printable Pdf Or Fill Online Health Insurance Marketplace Statement Templateroller

Tax Season Is Here Know Your Forms Enroll Nebraska

Form Irs 1095 A Fill Online Printable Fillable Blank Pdffiller

14 How Do Jennifer S Educator Expenses Affect Her Chegg Com

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Welcome To Aca Compliance

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Form 1095 A 1095 B 1095 C And Instructions